A tax incentive was introduced to encourage energy efficiency measures. Whether talk an SME or a large company, there are improvements and developments every year. From January 2017 on, companies are able to claim corporate tax relief if the investment serves energy efficiency purposes.

The amount of the investment can be deducted from the corporate tax for 5+1 years.

Before the investment or renovation starts, a previous energy audit must be carried out. The audit will assess and record the energy consumption of the area and equipment involved in the investment. In case of a new machine purchase, this means the technology area, but there are also cases where only the building is being renovated, in which case we focus on the building or the building engineering system itself. If a new vehicle is being purchased, then we look at the transport. The three sub-areas sum-up for the total energy consumption.

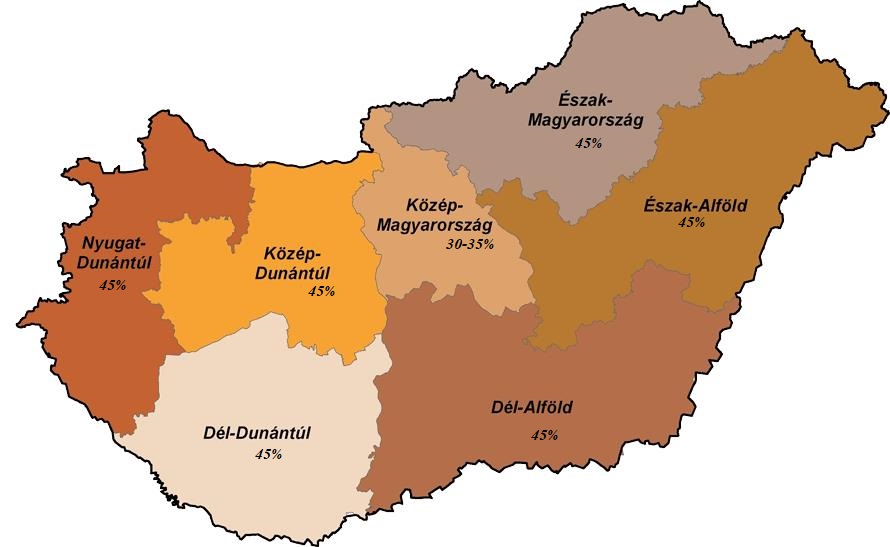

The amount of tax relief available may vary by region and by company size, up to a maximum of HUF 15 million. For medium-sized companies, the regional aid rate is +10%. For small enterprises, the aid rate per area is + 20%. The tax relief is available up to 70% of the calculated tax.

The conditions of application and use, the details of non-deductible costs, the detailed conditions of the proof of quality and the taxpayer’s obligation to provide information are set out in the Government Decree 176/2017 (VII. 4.) of the Government Decree on the basis of the authorisation of Act LXXXI of 1996 on Corporate Tax and Dividend Tax (Tao. tv.). The Act excludes only the combined application of the development tax credit (Section 22/B (1)

1075 Budapest

Madách Imre út 8. III. em 4.

+36 30 620 5389