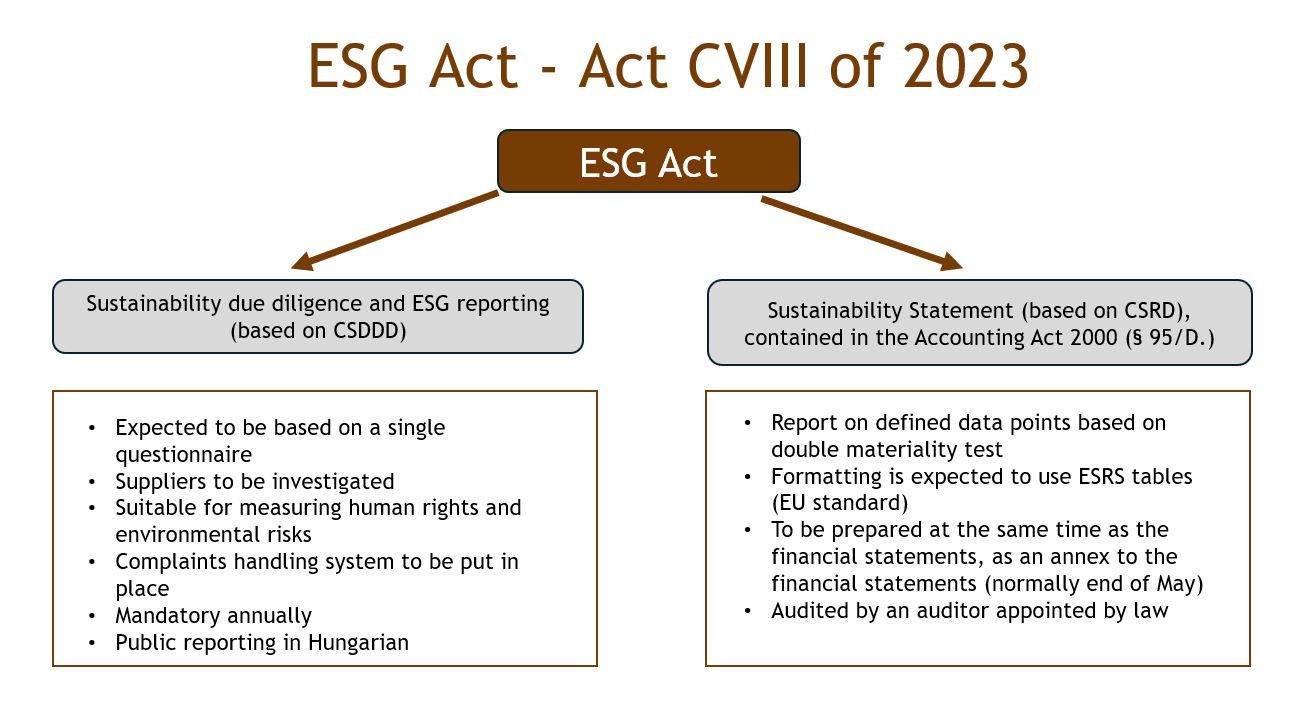

Although sustainability or ESG reports have been produced by large companies in the past, the methodology has not been consistent. We supported several clients in compiling these reports, but the depth of these reports was more a matter of the transparency of the company and the reports were not comparable. In Hungary, the first ESG law, based on the EU regulatory framework, entered into force on 1st January 2024, and is intended to support government objectives. Certain large companies will be required to report under the Act from 2024, but the precise details, such as certain accounting and risk management obligations, have not yet been published. The importance of sustainability/ESG reporting has been reinforced in recent years by the trend that investors, financial market participants and regulators increasingly expect companies to report on their sustainability and ESG (Environment, Social, Governance) performance and strategy.

Using a questionnaire to ask suppliers about their sustainability measures and performance. The report is prepared by the company in Hungarian within 6 months of the end of the year.

Environmental and human rights risk assessment,

measures

for reduction.

Handle, document and analyse complaints and signals from the company's stakeholders.

Involving the stakeholders concerned,

based on an assessment of the company's impact on the environment and the community.

Within 5 months for accounting reports. Mandatory audit after publication of the report. To be submitted as an annex to the financial statements, signed and submitted through the usual court procedure

A source of information for investors, a document that can be used to communicate action plans and results.

The MN6 Energy Agency team supports companies with both ESG reporting and ESRS data point based reporting under the Accounting Act.

1075 Budapest

Madách Imre út 8. III. em 4.

+36 30 620 5389